"Even Small contribution makes a large impact.”

Donate

Please Donate

If you have been waiting for the change, it stands right here, in front you.

The Trust is registered under section 12A of the I.T. Act and has exemption under section 80G of the I.T.Act,1961, which means 50% of your donations are exempted from tax under section 80G. The Trust account books are regularly audited by a Chartered Accountant and regularly filing the Income Tax Return since the inception of the Trust.

The Trust has been granted registration under Foreign Contribution (Regulation) Act,2010 vide registration No.137400037 dated 13/06/2023 and now our Trust is eligible for taking foreign donations only in newly opened FCRA Savings Account No.39972760116, Branch Code:00691, IFSC: SBIN0000691, SWIFT: SBININBB104 maintained in State Bank of India, FCRA Cell, 4th Floor, New Delhi Main Branch, 11, Sansad Marg, New Delhi-110001.

Payment Method (NGO Bank transfer):

#1

- Bank Account No. – 398502010103447

- IFS Code: UBIN0539856.

- Acc Name : Siddharth Memorial Charitable Trust,

- Bank name: Union Bank of India, Brahmputra Complex, Secor-29, Noida

#2

- Bank Account No. – 021001214101

- IFS Code: HDFC0CCBL02.

- Acc Name : Siddharth Memorial Charitable Trust,

- Bank name: Citizen Co-operative Bank, B-1A/36, Sector-51, Noida

Prayas Sponsorship Form

Here is our detailed sponsorship form if you are interested in donating

What our donors say?

Have questions regarding how we use donations?

How you can contribute?

- Financial Assistance either by sponsoring a child education or general donation.

- Volunteer Teachers

- Mentors for our innovative programs.

- Qualified experts in English, Maths, Science and Accountancy.

What our volunteers say?

I am motivated!

We need you!

Learn how you can become a volunteer today.

FAQs

Most frequent questions and answers

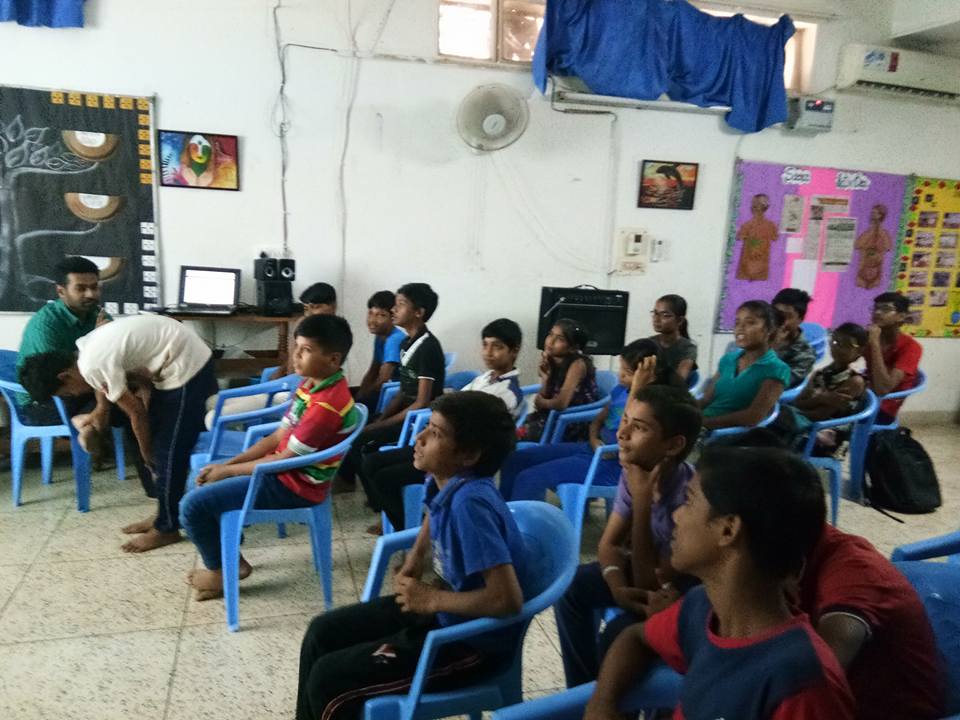

The Trust initiated the program “Ek Prayas” under which the quality education to less privileged children from Class-VI onwards from the academic session 2010-11, who are risk of discontinuing their studies due to very impoverished circumstances is being provided. The Trust support the less privileged children without considering his/her cast, creed and religion. The Trust is not only providing quality education but also emphasis on all round development of each child through a series of activities. Besides academics, the Trust also provides vocational training according to the interest of the child in; Dance, Art & Craft, Photography, Digital Marketing, Doodling, Robotics, Coding etc. Renowned teachers in these fields train them. The Trust supports the students in their holistic development till they get placement.

The whole beneficaries of the donations received are the studens of “Ek Prayas”. As the Trust has to pay the admission fee, Tutition fee of the students to the public school/college, where they are admitted. The Trust also provide books, stationery and school uniforms to the students.

The person who is well qualified and is passionate about teaching is given the opportunity to be a volunteer. Also an interview is conducted to ensure the volunteer is empathetic and has strong sentiments to devote his/her valuable time for the upliftment of less privileged children of the society.

Approx 70% of the donations received are utilized in the payment of School/College fee, Books, Stationery and School uniform. The main chunk of the balance amount is spent for the rented premises i.e. Rs.25000/-PM, which is utilized as our centre of the Trust. The administrative expenses are very nominal, as the most of the services provided i.e. tution classes in all subjects, workshops and motivating classes under the program “Ek Prayas” are given by our dedicated volunteers of the Trust voluntarily.

The Accounts of the Trust is regularly Audited by the Chartered Account of the Trust. The Turst is filing the I.T.return, since the inception of the Trust i.e. from the A.Y. 2010-11 to 2019-20. The Trust is also in process of filing ITR for the A.Y. 2020-21. Further any sponsors can inspect the accounts of the Trust by giving pre-intimation of 15days to the Managing Trustee.

All the donations are only received through banking channel i.e. Cheque, Draft, RTGS, NEFT and IMPS. The Trust never receive donations in cash.

Progress of each and every child is monitored in all spheres of development. Proper attendance chart is maintained in all activities not just in education. Marks are assigned to every activity, be it attending a life skill workshop or participating in a curricular activity. Since our approach is holistic, exams and tests are not the only means to judge IQ of the child. EQ and vocational skills acquired are also given equal weightage. So, that proper counselling can be given to the students to take right stream after 10th Grade and join appropriate course for graduation. Thus, ensuring good employability.

The Trust is registered under section 12AA of the I.T.Act,1961 vide C.No.57(41)/Regn.12A/CIT-GZB/2010-11 dated 25.03.2011 and Tax Exemption under section 80G granted vide C.No.58(55)/Tax Exemption/CIT-GZB/2010-11/4373 dated 25.03.2011. All the donations made by the Sponsors are subject to Tax exemptions u/s 80G of the I.T.Act,1961.

The person who is well qualified and is passionate about teaching is given the opportunity to be a volunteer. Also an interview is conducted to ensure the volunteer is empathetic and has strong sentiments to devote his/her valuable time for the upliftment of less privileged children of the society.